A Guide to IRS Levy Notices - What You Need to Know

Did you receive an IRS levy notice? Learn more about your rights.

If the IRS sends you a levy notice, it means they are taking action to collect unpaid taxes. It's important to understand both your rights and the process of collection before this happens. This guide explains how many notices the IRS can send before initiating levies and what to do if you receive one.

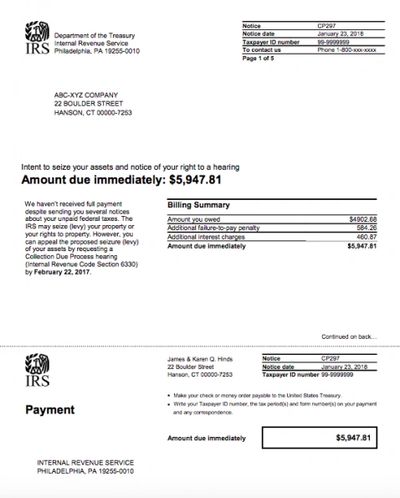

An IRS levy notice is a legal document issued by the Internal Revenue Service (IRS) that informs a taxpayer that the IRS intends to seize their assets to satisfy an outstanding taxes. The levy notice is typically sent after the taxpayer has failed to pay their taxes or has failed to respond to previous IRS notices or requests for payment.

The levy notice includes information about the amount of the taxes owed, the specific assets that are being targeted for seizure, and the steps that the taxpayer can take to prevent the levy from going forward. The Notice of Levy usually gives the taxpayer 10 days to do something about the Notice. The notice will also provide information about the taxpayer's right to appeal levies and to request a hearing to challenge the IRS's actions.

VERY IMPORTANT! – Receiving a notice letter like this requires that you contact a Tax Consultant such as an Enrolled Agent at once. As the saying goes, its harder to put the toothpaste back in the tube, easier to keep it in the tube. Your odds of dealing with this issue successfully are enhanced by taking early action.

How Many Times Will You Receive a Tax Levy Notice?

Generally, the IRS will send a taxpayer several notices before issuing a levy notice. The IRS is required by law to provide the taxpayer with written notice of the intent to levy and to give the taxpayer an opportunity to resolve the tax debt before seizing any assets

The sequence of notices typically includes:

- A balance due notice, which is sent after the taxpayer fails to pay their taxes on time.

- A series of reminder notices, which are sent if the taxpayer does not respond to the balance due notice.

- A final notice of intent to levy, which is sent at least 30 days before the IRS issues a levy. This notice explains the taxpayer's rights and options to resolve the tax debt before a levy is issued.

If the taxpayer does not respond to any of these notices or take steps to resolve their taxes, the IRS may issue a tax levy notice. However, the number of notices can vary depending on the circumstances of the case. In some cases, the IRS may move more quickly to issue a levy notice, while in others, it may send more notices before taking enforcement action.

How to Resolve an IRS Levy Notice

Receiving an IRS levy notice can be a stressful experience, but there are steps you can take to resolve the situation. Here are some options to consider:

- Pay the taxes in full: If you can afford to pay the entire tax amount, this is the fastest and most straightforward way to resolve the issue. You can pay online, by mail, or by phone using a credit or debit card, electronic funds transfer, or a check or money order.

- Negotiate a payment plan: If you can't afford to pay the full tax amount upfront, you can request a payment plan from the IRS. You can do this online or by submitting Form 9465, Installment Agreement Request. Depending on the amount owed, you may need to provide financial information to the IRS to support your request.

- You can request an offer in compromise. Please read my series titled, “Unlocking the Secrets of an Offer in Compromise: A Comprehensive Guide” for an in depth explanation of an Offer in Compromise. My five part series takes you through the offer process, how to calculate an offer, how to submit an offer, and appealing a OIC turndown.

- Challenge the levy: If you believe the IRS has issued the levy notice in error, you can request a collection due process hearing to challenge the levy. You must do this within 30 days of receiving the notice of intent to levy.

- Seek professional tax help: Dealing with the IRS can be complex, and it's often helpful to seek the assistance of a tax professional. A tax attorney or enrolled agent can advise you on the best course of action and help you navigate the process.

It's important to take prompt action when you receive an IRS levy notice. Ignoring the notice can lead to additional penalties and interest, and the IRS may proceed with seizing your assets to satisfy the tax debt.

Understanding the Collection Statute Expiration Date

The Collection Statute Expiration Date (CSED) is an important deadline established by the Internal Revenue Service (IRS) for the collection of back taxes. The CSED is the last day the IRS can take legal action to collect back taxes, and it is generally 10 years from the date the tax was assessed.

Once the CSED has passed, the IRS cannot take any further legal action to collect the taxes, and the tax is considered "uncollectible." However, it's important to note that the CSED can be extended or suspended in certain situations, such as if the taxpayer files for bankruptcy or if the taxpayer enters into an installment agreement or an offer in compromise with the IRS.

The CSED is determined by several factors, including the date the tax was assessed, the type of tax, and any actions taken by the taxpayer or the IRS to delay the collection process. The IRS will typically send the taxpayer a notice of the CSED, which will provide information about the deadline and any actions the taxpayer can take to resolve the tax debt before the deadline passes.

It's important for taxpayers to be aware of the CSED and to take action to resolve their taxes before the deadline expires. This may include negotiating a payment plan, requesting an offer in compromise, or seeking professional tax help. If the CSED has already passed, the taxpayer may have options for resolving the taxes, such as requesting that the taxes be classified as "currently not collectible" or seeking relief through a bankruptcy filing.

Do not hesitate to take action if you receive a Notice of Intent to Levy. Contact our office upon receipt and let us explain the situation to you, provide you with options, and explain our plan for resolution of the issue. irs levy notices

An Example of an IRS Levy Notice

Copyright © 2026 Austin-tax-help - All Rights Reserved.

For More Info

Contact Martin Cantu, EA

512-522-6036

Cookie Policy

This website uses cookies. By continuing to use this site, you accept our use of cookies.