Understanding IRS Notice 503

What you need to know.

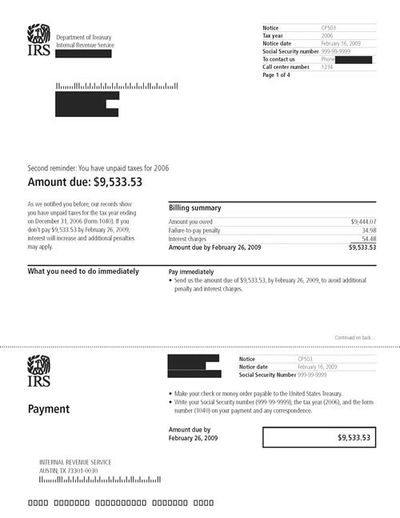

This is the third notice for individuals, second for businesses, received from the IRS regarding your tax amount due. Accordingly, this notice should be taken more seriously than IRS Notice CP 14 or CP 501. This is proof that the IRS is not going away and expects a response sooner rather than later. You are moving down the collection highway to getting a lien filed against you and your property, or having the painful experience of a levy or garnishment.

First - Don't Panic. Yes, receiving a notice from the IRS can be a stressful experience, but it's important to stay calm and take action. If you've received IRS Notice CP 503, it means that you have an unpaid tax balance and the IRS is requesting payment, for the second or third time. This guide will help you understand what the notice means and what steps you need to take next to resolve the issue. Procrastination means you would really benefit from the guidance that only an Enrolled Agent can provide.

What is IRS Notice CP 503?

IRS Notice CP 503 is a notice sent by the IRS to inform taxpayers that they have an unpaid tax balance. The notice includes the amount owed, the tax period in question, and any penalties or interest that have accrued. It also provides instructions on how to resolve the issue, including payment options and deadlines. It's important to take action promptly to avoid further penalties and potential legal action by the IRS.

What does it mean for your taxes?

IRS Notice CP 503 means that you have an unpaid tax balance and need to take action to resolve the issue. The notice will include the amount owed, the tax period in question, and any penalties or interest that have accrued. It's important to review the notice carefully and take action promptly to avoid further penalties and potential legal action by the IRS. Payment options and deadlines will be provided in the notice, so be sure to follow the instructions provided.

How to respond to IRS Notice CP 503.

If you've received IRS Notice CP 503, it's important to take action promptly to avoid further penalties and potential legal action by the IRS. The notice will include the amount owed, the tax period in question, and any penalties or interest that have accrued. Payment options and deadlines will be provided in the notice, so be sure to follow the instructions provided. You can choose to pay the balance in full, set up a payment plan, or request an offer in compromise. If you believe there is an error on the notice, you can also contact the IRS to dispute the balance owed. It's important to respond to the notice within the timeframe provided to avoid further consequences.

Common reasons for receiving IRS Notice CP 503.

There are several common reasons why you may receive IRS Notice CP 503. One of the most common reasons is that you have unpaid taxes from a previous tax year. This could be due to a mistake on your tax return, failure to file a return, or underpayment of estimated taxes. Another reason could be that you have not responded to previous notices from the IRS regarding your tax debt. Additionally, if you have a payment plan in place but have missed payments or failed to meet the terms of the agreement, you may receive this notice. Whatever the reason, it's important to take action promptly to avoid further penalties and legal action.

Tips for avoiding future notices.

To avoid receiving future IRS notices, it's important to stay on top of your tax obligations. This includes filing your tax returns on time, paying any taxes owed by the deadline, and responding promptly to any notices or requests from the IRS. If you're struggling to pay your taxes, consider setting up a payment plan or seeking assistance from a tax professional. It's also a good idea to review your tax returns carefully before submitting them to ensure that all information is accurate and complete. By taking these steps, you can help prevent future IRS notices and avoid the stress and financial burden that comes with tax debt.

Let me take on your burden and help you. My tax consults are free and I will work with you on both a payment method and payment plan for our services.

Look in the upper right hand corner for the notice number.

Copyright © 2026 Austin-tax-help - All Rights Reserved.

For More Info

Contact Martin Cantu, EA

512-522-6036

Cookie Policy

This website uses cookies. By continuing to use this site, you accept our use of cookies.