How to Respond to IRS Notice CP 14

A Step-by-Step Guide

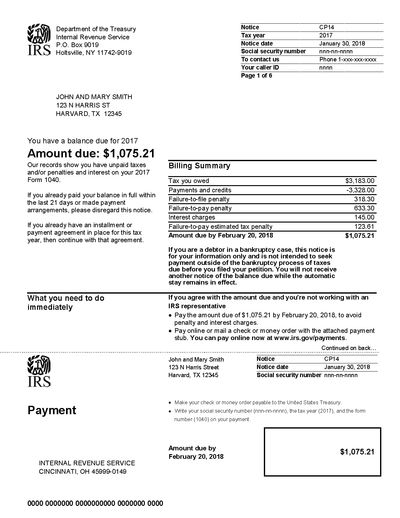

The IRS has resumed sending out collection notices after pausing during the pandemic. Receiving an IRS Notice CP 14 can be a stressful experience, but it's important to stay calm and understand what it means. This notice typically indicates that you owe money to the IRS, but it also provides information on how to resolve the issue. Follow this step-by-step guide to learn more about Notice CP 14 and how to respond.

What Triggered the IRS CP 14?

The IRS processed your return and you have an amount due. You may already know this having submitted your return with a balance due. If you did not show an amount due, the IRS may have determined that:

· You have a math error in your return.

· There was another kind of error.

· Credits claimed on your return could not be verified.

· Income items were verified with some income being added to your return.

In each case you would have received a notice of an adverse IRS action prior to receiving your IRS CP 14.

Understand the Notice CP 14.

You just entered the IRS collection process. So much of this process consists of automated letters and notices with the CP 14 being your initial notice in that process. The first step in responding to a Notice CP 14 is to understand what it means. This notice is typically sent when you have an unpaid tax balance with the IRS. It contains the amount of tax due, the amount of penalties and interest, and requests payment within 21 days. You can also look at prior notices regarding the processing of your return discussed in the prior paragraph as an indication of what went wrong. Review your notice carefully. It will provide information on the amount owed, the tax period in question, and any penalties or interest that have accrued. It's important to carefully review the notice and make note of any deadlines or instructions provided.

Determine the Amount You Owe.

The first step in responding to an IRS Notice CP 14 is to determine the amount you owe. The notice will include the tax period and the amount owed, including any penalties and interest. It's important to verify that this information is accurate before taking any further action. If you believe there is an error, you can contact the IRS to request a correction.

The notices you may received during the processing of your return usually fall under two categories:

· Math errors.

· Issues that arise during what is referred to as the IRS Matching program. The IRS matches data filed under your (and you spouse’s) social security numbers to determine the accuracy of what you included in your return.

Errors happen – on both the taxpayer’s part but also those reporting income and expense items. This is your best opportunity to look into any discrepancies and correct them.

Once you have verified the amount owed, you can begin to explore your payment options.

Decide on a Payment Plan.

After verifying the amount owed, it's important to decide on a payment plan that works for you. The IRS offers several options, including installment agreements, offers in compromise, and temporary delay of collection. I go into detail into these options in other parts of my website. You can click on the highlight text to find a more detailed discussion on those topics. Installment agreements allow you to make monthly payments over time, while offers in compromise allow you to settle your tax debt for less than the full amount owed. Temporary delay of collection may be an option if you are experiencing financial hardship. It's important to carefully consider your options and choose the one that best fits your financial situation.

What Happens if I Don’t Respond to the Notice?

This is generally the first notice in the IRS collection process. Failure to respond will result in additional notices ending in a Tax Lien, a Levy on bank accounts, or Garnishment of your wages.

Respond to the Notice.

Once you have received an IRS Notice CP 14, it's important to respond promptly. Ignoring the notice could result in additional penalties and interest charges. The first step is to verify the amount owed by reviewing your tax return and any supporting documents. If you agree with the amount owed, you can choose to pay in full or set up a payment plan. If you disagree with the amount owed, you can request a review or appeal. It's important to follow the instructions on the notice and respond within the specified timeframe.

Why you may need a professional to assist you.

Taxpayers can handle most issues on their own. However, if your balance is large, or you have other unusual circumstances, having an Enrolled Agent assist you may be cheaper and more effective for you in the long run.

Austin Tax Help provides clients with a number of payment options and payment terms to assist you with your tax issues. Tax issues are unpleasant and the last thing you want to handle. Give me a call and we can work out a plan together to resolve your tax issues and give you some much needed peace of mind.

Look at the top right corner of your notice to determine the notice number.

Copyright © 2026 Austin-tax-help - All Rights Reserved.

For More Info

Contact Martin Cantu, EA

512-522-6036

Cookie Policy

This website uses cookies. By continuing to use this site, you accept our use of cookies.