IRS Notice CP 501

Common Questions and Answers

Receiving an IRS Notice CP 501 can be a stressful experience, but it's important to take action and address any issues with your taxes. This article provides answers to common questions about the notice and offers tips on how to respond and resolve any outstanding tax liabilities.

A Reminder of What You Owe

If you receive an IRS Notice CP 501 in the mail, it means that you have an outstanding tax debt that needs to be resolved as soon as possible. Ignoring the notice will only result in additional penalties and interest, which will increase the amount you owe over time. To avoid further financial consequences, it's important to take action and address the issue promptly.

If you receive an IRS Notice CP 501, don't panic. This notice is simply a tool to help you pay off any outstanding tax debt you may have. The notice provides all the necessary information you need to make a payment, including the amount owed and payment options. So take a deep breath and use the notice as a guide to resolving your tax debt.

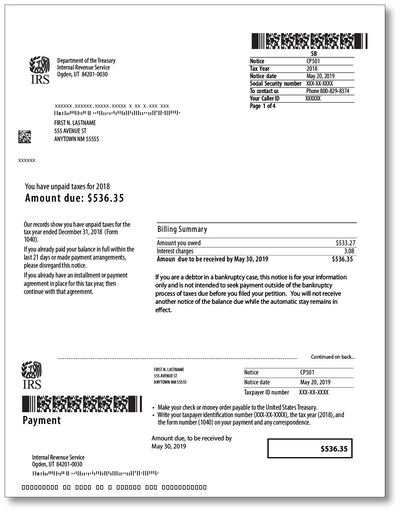

IRS Notice CP 501 is a notification sent by the Internal Revenue Service to inform taxpayers of the amount they owe in taxes. This notice is typically sent after the IRS has reviewed the taxpayer's tax return and determined that there is a balance due. The notice will include information on how to pay the amount owed and any applicable penalties or interest. It is important for taxpayers to respond promptly to this notice to avoid further collection actions by the IRS.

What is an IRS Notice CP 501?

An IRS Notice CP 501 is a reminder notice that is sent to taxpayers who have an outstanding tax balance. It is typically sent after the IRS has sent a series of notices requesting payment and the taxpayer has not responded or made arrangements to pay the balance. The notice will include the amount owed, the due date, and instructions on how to resolve the issue.

What should I do if I receive an IRS Notice CP 501?

If you receive an IRS Notice CP 501, it’s important to take action as soon as possible. Ignoring the notice could result in further penalties and interest charges. The first step is to review the notice and verify that the information is correct. If there are any errors, contact the IRS immediately to have them corrected. If the information is correct, you have several options for resolving the outstanding balance, including setting up a payment plan or submitting an offer in compromise. It’s recommended to consult with a tax professional for guidance on the best course of action for your specific situation.

What are the consequences of ignoring an IRS Notice CP 501?

Ignoring an IRS Notice CP 501 can lead to serious consequences, including additional penalties and interest charges. If you continue to ignore the notice, the IRS may take further action, such as placing a lien on your property or garnishing your wages. It’s important to take action as soon as possible to avoid these consequences and resolve the outstanding balance. If you’re unsure of what steps to take, consult with a tax professional for guidance.

Can I negotiate a payment plan with the IRS?

Yes, you can negotiate a payment plan with the IRS if you are unable to pay the full amount owed. This is known as an installment agreement. You can apply for an installment agreement online, by phone, or by mail. The IRS will review your financial situation and determine the amount of your monthly payments. Keep in mind that interest and penalties will continue to accrue until the balance is paid in full. It’s important to make your payments on time to avoid further consequences.

How can I prevent receiving an IRS Notice CP 501 in the future?

The best way to prevent receiving an IRS Notice CP 501 in the future is to ensure that you are accurately reporting your income and paying your taxes on time. Keep detailed records of your income and expenses, and consider hiring a tax professional to help you navigate the tax code. If you are self-employed, make sure to pay estimated taxes throughout the year to avoid a large tax bill at the end of the year. Finally, if you are experiencing financial hardship, consider reaching out to the IRS to discuss your options for payment plans or other forms of relief.

At Austin-Tax-Help, we specialize in providing expert tax services for both individuals and businesses. Our team of experienced tax professionals is dedicated to helping you navigate the complex tax landscape and get the most out of your returns. Whether you need help with tax planning, preparation, or filing, we have the expertise to help you achieve your goals. We also offer audit representation, so you can rest easy knowing that your finances are in good hands.

Look in the upper right hand corner of the notice to determine the notice number.

Copyright © 2026 Austin-tax-help - All Rights Reserved.

For More Info

Contact Martin Cantu, EA

512-522-6036

Cookie Policy

This website uses cookies. By continuing to use this site, you accept our use of cookies.