IRS Notices and IRS Collection Letters

What does my IRS notice mean?

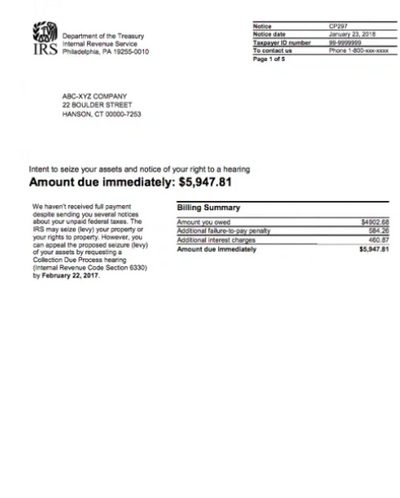

One of the first things we evaluate is how deep you are into the IRS collection process. Keep in mind the IRS has many different notices and letters. You can find the notices listed in the top right hand corner of the notice. Here are a few of the more common IRS notices and letters:

CP88 - The IRS is holding your refund because you haven’t filed one or more tax returns, and it believes you will owe tax.

CP90 –The IRS is notifying you of its intent to levy certain assets for unpaid taxes. You have the right to dispute the levy in a Collection Due Process hearing.

CP297 - (for Businesses). The IRS is notifying you of its intent to levy certain assets for unpaid taxes. You have the right to dispute the levy at a Collection Due Process hearing.

CP298 - The IRS notifying you of its intent to levy up to 15% of your social security benefits for unpaid taxes.

CP504 - You have an unpaid amount due on your account. If you do not pay immediately, the IRS will levy your state income tax refund to apply it to the amount you owe.

Letter 1615 (LT 18) - You must respond to the IRS within 10 days of this notice regarding past due tax returns.

Letter 2050 (LT 16) - The IRS is trying to collect unpaid taxes from you from returns that have been filed or from returns that have not been filed.

Knowing this information up front allows us to prepare a plan tailored to your needs.

Look closely at the number of the IRS Notice Letter you receive.

IRS Notices and IRS Collection Letters

What should I do if the IRS is contacting me?

If you are facing IRS collections for unpaid taxes, it's important to take action as soon as possible to resolve your tax debt and avoid further penalties and interest. Here are some steps you can take to approach IRS collections in a proactive and effective manner:

- Contact the IRS: If you are receiving notices or calls from the IRS about unpaid taxes, it's important to respond as soon as possible. You can contact the IRS to discuss your options for resolving your tax debt and to ask for help understanding your tax notice.

- Gather information: You will need to provide the IRS with detailed information about your financial situation in order to determine the best way to resolve your tax debt. This may include information about your income, expenses, and assets.

- Consider your options: There are several options available for resolving your tax debt, including paying the full amount owed, entering into an installment agreement, or applying for an Offer in Compromise. Each option has its own requirements and eligibility criteria, so it's important to carefully review your options and choose the one that best fits your situation.

- Seek professional assistance: If you are unsure about how to approach your tax debt or are having difficulty resolving it on your own, it may be helpful to seek the assistance of a tax professional or a qualified tax resolution specialist. These professionals can provide expert advice and help you navigate the process of resolving your tax debt.

Overall, the best way to approach IRS collections is to be proactive and take steps to resolve your tax debt as soon as possible. This will help you avoid further penalties and interest and get your financial situation back on track.

Look closely at the number in the upper right hand corner.

Copyright © 2026 Austin-tax-help - All Rights Reserved.

For More Info

Contact Martin Cantu, EA

512-522-6036

Cookie Policy

This website uses cookies. By continuing to use this site, you accept our use of cookies.